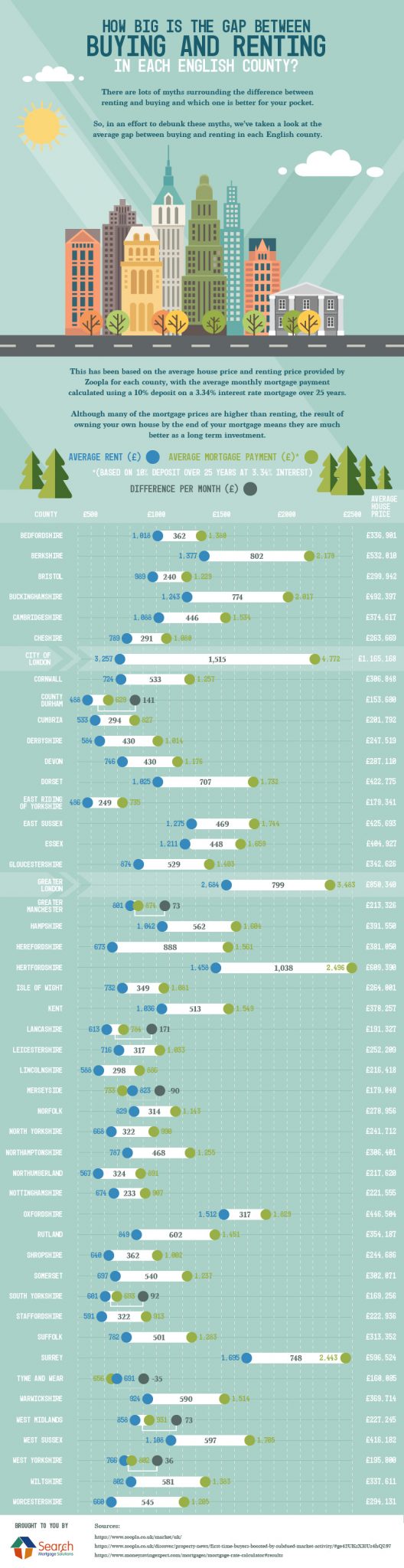

There are lots of myths surrounding the difference between renting and buying and which one is better for your pocket.

So, in an effort to debunk these myths, we’ve taken a look at the average gap between buying and renting in each English county.

This has been based on the average house price and renting price provided by Zoopla for each county, with the average monthly mortgage payment calculated using a 10% deposit on a 2.63% interest rate mortgage over 25 years.

Although many of the mortgage prices are higher than renting, the result of owning your own house by the end of your mortgage means they are much better as a long term investment.

Use the Snippet below to embed the infographic.